CITIZENSHIP BY INVESTMENT

Citizenship by Investment (CBI) offers a structured route to a second passport through a qualifying investment, allowing you to obtain dual citizenship within a defined, streamlined process. By allocating capital to a stable jurisdiction, you can accelerate the path to citizenship while securing long-term mobility and optionality.

Typical advantages include expanded visa-free access, greater freedom of movement, and improved lifestyle flexibility for you and your family. When approached properly, CBI is more than a travel upgrade—it’s a strategic asset that strengthens personal security, family planning, and global access.

Citizenship by Investment

Top Citizenship Programs

Antigua and Barbuda showcases a remarkably competitive citizenship program in the Caribbean, offering options starting from USD 230,000

Experience the crown jewel of the Caribbean, offering a tranquil retreat amidst stunning natural scenery and superior living standards, with citizenship starting from USD 200,000.

Famously dubbed the Spice Island for its abundant array of locally sourced spices, Grenada boasts one of the Caribbean's most enchanting coastlines, with citizenship starting from USD 235,000.

St. Kitts & Nevis, a Caribbean jewel boasting breathtaking natural landscapes, azure skies, and pristine sandy shores, offers citizenship by investment starting at USD 250,000.

Find your tropical haven in Saint Lucia, where citizenship by investment unlocks a world of elegance, exclusivity, and opportunity from USD 240,000.

Türkiye's unique position bridging Europe and Asia, diverse economy, and rich culture make it an attractive investment destination, offering citizenship through a minimum USD 400,000 investment in its Citizenship by Investment program.

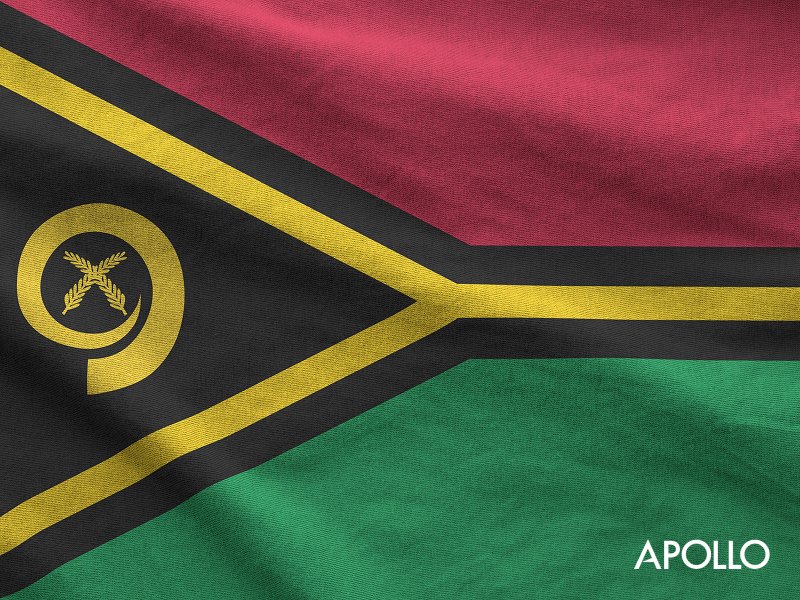

Vanuatu combines exceptional natural beauty with political stability, economic resilience and a secure social framework.

WHY SECURE A SECOND CITIZENSHIP?

Safety, Stability and Options

A second passport is a strategic layer of protection—designed to reduce dependence on a single country’s politics, policy shifts, or economic volatility. It gives you and your family the option to relocate quickly to a stable jurisdiction, with the flexibility to safeguard assets and maintain continuity when conditions change.

Beyond personal safety, it supports long-term wealth planning and cross-border security—so your lifestyle, business, and capital are less exposed to single-jurisdiction risk.

Enhanced Global Mobility

A second passport expands your freedom of movement and reduces reliance on a single nationality for travel, access, and long-term planning. It can provide broader visa-free reach, smoother cross-border flexibility, and a practical advantage when opportunities—or disruptions—require you to move quickly.

More importantly, it adds optionality: the ability to reposition your family, lifestyle, and assets toward a stable jurisdiction when conditions change, without scrambling for last-minute solutions.

An Elevated Quality of Life

A second citizenship can unlock access to jurisdictions known for stability, strong public services, and a high standard of living. It gives you the flexibility to choose where your family spends time—whether that means better healthcare, stronger education options, cleaner environments, or a more predictable day-to-day lifestyle.

More than a change of scenery, it’s the ability to design life on your terms: where you live, how you travel, and what opportunities you can access—without being limited by a single passport.

Key Facts About Citizenship by Investment

What is Citizenship by Investment?

Citizenship by Investment (CBI) is a government-backed pathway to acquiring citizenship and a second passport through a qualifying financial contribution to a country. Instead of years of residency, CBI provides a structured, legal route with clear eligibility criteria, defined investment options, and an established processing timeline.

For investors and globally mobile families, CBI is best understood as a planning tool: it expands travel access, strengthens long-term security, and adds jurisdictional optionality for lifestyle, family continuity, and future contingency. Reputable programs apply rigorous due diligence and compliance standards, and successful applicants gain full citizenship rights under the laws of the host country.

What are the different ways of obtaining citizenship?

There are several established routes to a second citizenship. The right pathway depends on your timeline, eligibility, and the level of certainty you need.

-

Naturalization (Residency → Citizenship)

The traditional route. You obtain legal residency and, after meeting minimum residence and integration requirements over several years, you may become eligible to apply. -

Citizenship through Marriage

Marriage to a citizen can provide a pathway—often starting with residency, then progressing to citizenship after meeting legal and time-based requirements. -

Citizenship by Descent (Ancestry)

If you can prove qualifying lineage, some countries allow you to claim citizenship through parents or grandparents. It can be highly efficient, but eligibility is narrow and documentation-heavy. -

Citizenship by Exception (Discretionary Grants)

Rare and selective. Granted by a state in recognition of exceptional contribution or national interest, and not a predictable route. -

Citizenship by Investment (CBI)

A structured, government-approved pathway that grants citizenship through a qualifying investment or contribution. It is typically the most time-efficient route, often allows family inclusion, and offers clear requirements, due diligence, and processing timelines.

What are the most common ways to acquire Citizenship by Investment?

CBI programs differ by country, but most investment routes fall into a few clear structures. The right option depends on whether your priority is speed, capital preservation, potential returns, or long-term portfolio fit.

-

Donations or Contributions

A direct contribution to an approved national development fund. This is typically the most straightforward route and offers fast execution, but it is not recoverable capital. -

Real Estate Investment

Purchase of approved property (or shares in qualifying developments, depending on the program). This option is often chosen by investors who want asset backing and the potential to recover capital after the required holding period, sometimes with rental or dividend upside. -

Government Bonds or Securities

Investment into approved bonds or similar instruments. These routes are generally designed for capital preservation and predictability, with returns typically secondary to stability. -

Hybrid Structures

A combination of two components—commonly real estate plus a contribution, or investment plus fees/levies—structured to broaden economic impact while meeting program requirements. -

Business Investment and Job Creation

Investment into an operating business or a new venture that meets defined thresholds (capital deployed, jobs created, economic contribution). This route can suit entrepreneurs seeking both citizenship and strategic market entry, though it tends to be more involved operationally.

What are the requirements to obtain Citizenship by Investment

While Citizenship by Investment programs differ by jurisdiction, most follow a consistent framework built around eligibility, compliance, and a qualifying investment. In general, applicants are expected to:

- Demonstrate a clean legal and background record

- Provide clear evidence of a lawful source of funds

- Submit a complete, accurate application with supporting documentation

- Make a qualifying investment in an approved option

- Meet minimum age requirements (typically 18+)

Most programs do not require long-term residence as a condition of approval. However, some jurisdictions include defined physical presence or residency expectations, while others allow applicants to obtain citizenship without it.